Route 2020: Assessing the Impact on Real Estate

Dubai Metro line’s positive impact on the development, pricing, and demand of land and real estate within surrounding areas.

The connectivity and efficiency of road and transport networks, including public transport, is a core pillar of any city’s growth and urbanization. To this extent, the development of the metro line in Dubai, which was inaugurated on the 9th September 2009, has transformed the landscape and accessibility of various locations across the city. More significantly, it had a positive impact on the development, pricing, and demand of land and real estate within surrounding areas.

The same can be expected of the new metro line extension, Route 2020, inaugurated on 8th July 2020, particularly as the city grows further inland and towards the South, as those locations offer more undeveloped land.

Impact on development

To illustrate the impact on development, the below image shows the areas around Barsha and Barsha Heights along the Sheikh Zayed road, prior to the announcement of the existing metro line in 2005.

A clear increase in development activity can be seen in the below image of the same areas in the year 2009, when the Dubai metro was inaugurated and one of the first metro stations began operations in Barsha. The residential stock along Sheikh Zayed road increased from 12,200 units in 2005 to 50,200 units in 2009 as the communities in that area gained popularity due to increased accessibility. This has also led to an increase in population density along those same lines, with the population of Barsha First increasing from 2,088 persons in 2005 to 5,284 persons in 2009, according to Dubai Statistics Center.

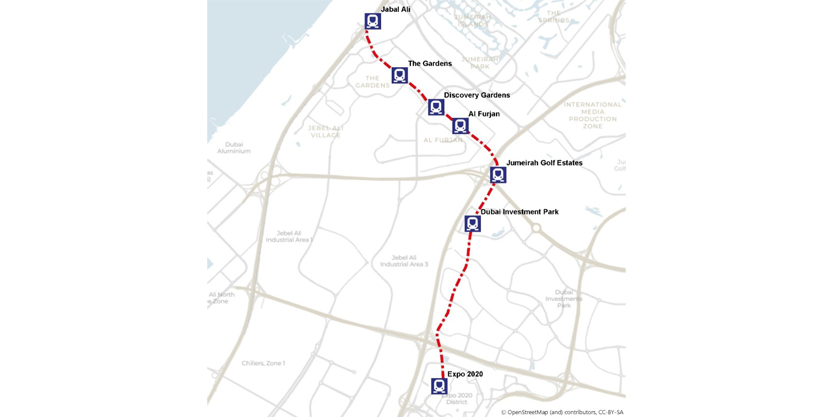

The below map points out that Route 2020 passes through several mature densely populated communities like Discovery Gardens, The Gardens, Al Furjan, and Dubai Investment Park (DIP), with an aggregate residential stock of around 16,500 units consisting of apartments and villas/townhouses. In addition, the Route will pass through newer residential and commercial nodes like Dubai South, which has an existing residential stock of just 3,000 units.

However, looking at under construction and announced stock, we observe an additional 5,500 residential units expected to enter the market in Dubai South. This compares to only 2,500 units expected in the existing communities mentioned above. This indicates increased developer interest in Dubai South, as the area matures, and is supported by Route 2020. Major projects expected to enter the market in the next two years in these communities include Glamz by Danube in Al Furjan, Emaar South and The Pulse in Dubai South.

The extension of the metro line is not only expected to encourage the development, and impact demand for, residential products, but is also expected to increase commercial activity and footfall as a result of the ease in accessibility.

Impact on Demand

According to Dubai Statistics Center, the population of Jabal Ali municipality which consists of Discovery Gardens, The Gardens and Al Furjan increased from around 45,900 in 2014 to 75,200 in 2019. This represents a 75% increase in population, which is well above the 44% increase in the total population of Dubai during the same period. While this can primarily be attributed to the lower rental rates in these secondary locations, improved accessibility through the new metro route is expected to increase the popularity of these locations even further.

This has also resulted in increased investor demand. According to data from REIDIN, the highest number of residential transactions during the period of 2014 to June 2020 were recorded in Al Furjan, at around 3,600. This was closely followed by Discovery Gardens at 2,800 transactions during the same time period. Dubai South recorded the lowest number of transactions at 200, which is also due to the limited availability of existing stock. When analyzing off-plan transactions however, the highest number were recorded in Dubai South at 6,300 over the same period. While this also reflects lower unit prices, it is also an indication of expected growth in demand, as the overall infrastructure in the area improves, and more supply is handed over

Impact on Property Rents & Prices

The development of the metro has also influenced the capital and rental values of buildings, with those in close proximity to the metro station commanding premiums, when compared to other similar buildings in the same area.

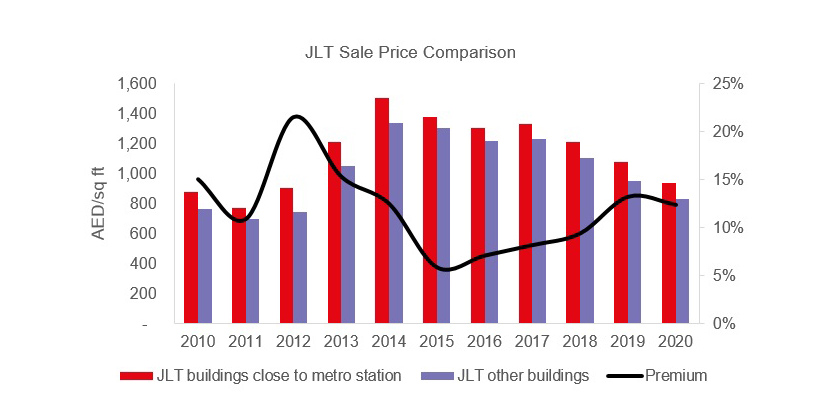

To illustrate the impact of metro on property prices, the below chart compares a sample of buildings in close proximity to the metro station in JLT with similar quality buildings in the area. According to data from REIDIN, since 2010, buildings in close proximity to the metro station have commanded average premiums of around 12% in sale and rental prices respectively, when compared to similar quality buildings in JLT. A similar trends can be recorded for rental prices, with buildings in close proximity to metro stations commanding average premium of around 11% for the same time period.

Similarly, buildings close to the metro station in Barsha Heights have registered higher rental prices, by around 6% when compared to similar buildings in the same area since 2011. A similar trend was also recorded along Route 2020 in Dubai Investment Park (DIP), where residential developments in DIP 1 commanded premiums of 18% in sale prices when compared to residential developments in DIP 2.

The new Route 2020 passes through communities which are classified as secondary locations when compared to other premium options available in Dubai. With the market demand shifting more towards end users and affordable housing in the long term, these areas can be expected to gain popularity due to the increase in accessibility. This is consequently expected to reflect positively on the performance of assets within those locations.