Patient Care Delivery Under Scanner: Primary Healthcare in KSA

KSA is one of the most active countries in the region in terms of transforming their healthcare offerings. As part of the National Transformation Program, the Ministry of health is working towards offloading the provision of care, to take a more active role in regulations and governance.

Healthcare systems globally and in the GCC have been under increased pressure to reduce cost of care, owing to various economic factors such as lower oil prices, in addition to the Covid-19 pandemic. As a result, countries are now actively focusing on prevention, as well as cure, to decrease costs and pressure on hospitals and healthcare facilities.

The World Health Organization defines primary health care (PHC) as a “whole-of-society approach to health that aims at ensuring the highest possible level of health and well-being and their equitable distribution by focusing on people’s needs and as early as possible along the continuum from health promotion and disease prevention to treatment, rehabilitation and palliative care, and as close as feasible to people’s everyday environment."

The importance of PHC is immeasurable as it is arguably one of the most vital cogs of the overall wellbeing of the population. PHC is the most comprehensive, inclusive, cost effective, efficient approach to enhance and manage the population’s physical and mental wellbeing. It is well known that with comprehensive primary care, up to 40% of all hospitalization/procedures through awareness and early detection can be decreased.

Primary Healthcare in KSA

KSA is one of the most active countries in the region in terms of transforming their healthcare offerings. As part of the National Transformation Program, the Ministry of health is working towards offloading the provision of care, to take a more active role in regulations and governance.

Looking for more insights? Never miss an update.

The latest news, insights and opportunities from global commercial real estate markets straight to your inbox.

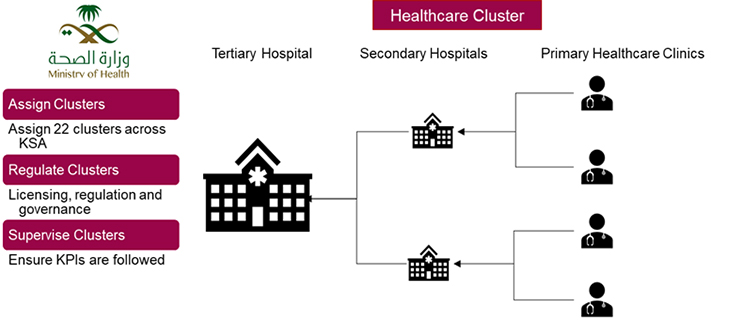

The initiative, which is currently taking place and is expected to be completed by year 2030, focuses on funneling down current providers into 22 clusters, which are accountable care organizations that are responsible for a set number of populations.

Each cluster will comprise of a tertiary care hospital, supported by several secondary hospitals and numerous primary healthcare centers.

The main objective of the MOH is to decrease the burden of disease by focusing on primary healthcare, which revolves around promotion of health, prevention of disease, management of illness and rehabilitation.

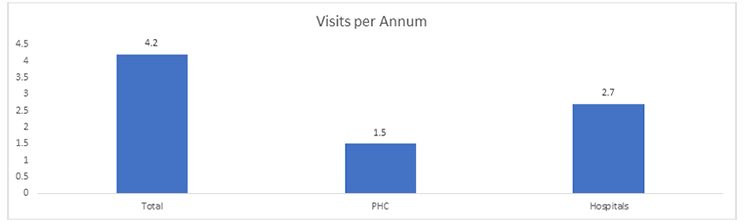

Currently, PHC visits in KSA make up around 25-35% of all healthcare facility visits. The average number of visits per population to PHC in the kingdom was calculated around 1.5 out of 4.2 visits per annum, a number that is significantly lesser than more mature markets. To enjoy the benefits of PHCs, roughly 70-80% of total visits need to be streamlined through PHCs, which increases the number of visits per annum to 3.

A shift towards a market that focuses on primary health care would mean a major increase in the number of visits that the kingdom is going to expect, with the number of PHC visits growing by 2-3 times.

Additionally, insurance companies have included comprehensive primary care in most of their plans, to decrease the overall bill of care to their individuals.

Investors perspective

Infrastructure:

Most upcoming residential masterplans have a provision supporting facilities such as education, retail, entertainment, and healthcare components. Primary health care centres will always be part of such masterplans, catering to the immediate population of its residents and workers.

Considering the average size of PHCs in the region, and the capacity of each clinic within a PHC, there will be a need of around 670,000 sqm of built up area per 1,000,000 population to accommodate the primary healthcare needs of the people.

Economy of scale:

Healthcare players have started to take note of the importance of primary health care centres and the effect that they have in geographical growth and reach, as well as having referring points to their secondary and tertiary facilities.

Mergers and Acquisitions:

Organized healthcare players may look at acquiring smaller facilities to add to their portfolio and service offerings to their patients. This consolidation will result in more economies of scale for the players and better negotiation power with insurance.

Public Private Partnership:

With oil prices down, and the full global economic impact of Covid-19, governments in the region have started opening to the private sector, making way for multiple public private partnership opportunities. KSA has already started piloting the idea of privatizing the primary health care space in select regions and clinics to further improve their offerings to their residents.